3 SHARED TRAITS OF THE WORLD’S GREATEST INVESTORS

1. All of them have an independent spirit and don’t mind being the odd man out.

2. All of them have patience.

3. All of them have the emotional stability to withstand adversity.

5 OF THE WORLD’S GREATEST INVESTORS

1. Benjamin Graham – He is known as the father of value investing. Graham was Warren Buffett’s teacher and mentor at Columbia University. In his book, The Intelligent Professor, he lays out the fundamental strategies of value-investing.

1. Benjamin Graham – He is known as the father of value investing. Graham was Warren Buffett’s teacher and mentor at Columbia University. In his book, The Intelligent Professor, he lays out the fundamental strategies of value-investing.

2. Warren Buffet – Using the principals of Benjamin Graham, Buffett had confidence in the stock market ahead of his time. He has acquired a multibillion dollar fortune and plans to give much of it away. Buffet has proved that patience wins in the investment market. Buffett displays confidence from within, and is self reliant.

2. Warren Buffet – Using the principals of Benjamin Graham, Buffett had confidence in the stock market ahead of his time. He has acquired a multibillion dollar fortune and plans to give much of it away. Buffet has proved that patience wins in the investment market. Buffett displays confidence from within, and is self reliant.

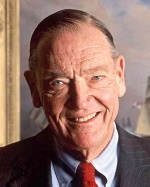

3. John (Jack) Bogle – He founded the Vanguard Group in 1974 and now this investment company is one of the largest and most respected. Bogle created many firsts like the no-load mutual fund and the index fund. His investing strategy centers around capturing market returns.

3. John (Jack) Bogle – He founded the Vanguard Group in 1974 and now this investment company is one of the largest and most respected. Bogle created many firsts like the no-load mutual fund and the index fund. His investing strategy centers around capturing market returns.

4. William H. Goss – Bill Goss is known as the “king of bonds.” He escalated his investment business to become a world leader in bond funds management. Apparently, he is in the Hall of Fame of the Fixed Analysis Society for his contributions in bond analysis.

5. George Soros – He is one of the most successful hedge-fund managers. His fortune is estimated as 24.5 billion dollars. He has his own theory called, reflexivity, where he explains finance. Mr. Soros believes the market is driven by behavior rather than common sense.

WHAT CAN WE LEARN FROM THE WORLD’S GREATEST INVESTORS?

Each of these investors displayed the will to learn. All of them read and studied to reach their own unique investment conclusions. Also, each of these investors borrowed successful investment ideas. Another trait of these investors is that all of them have failed. This is not to say when they have won, that they did not win big. But, these investors learned that failure becomes the first step to winning. Lastly, all of these investors judge themselves by an internal clock and do not feed off external criticism or doubt. What traits do you share with the world’s greatest investors?